Being “Cheap”

October 30, 2017

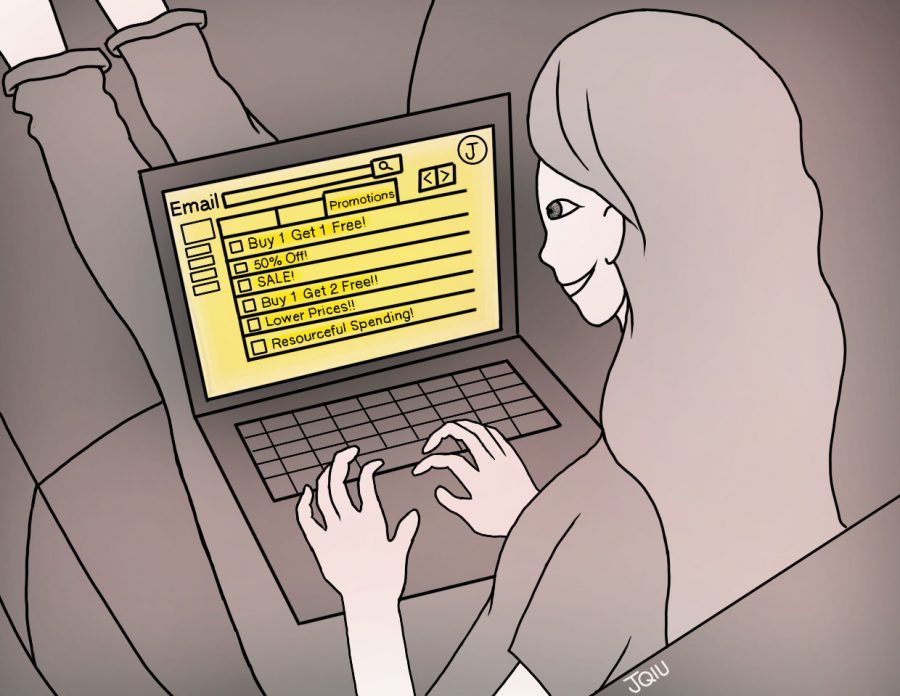

When I check my mailbox every week, without fail, there will be a booklet of coupons nestled amongst the envelopes and magazines. Phrases like “Buy one get one free” and “50% off” are always a pleasant sight for me. It is always a pleasure to see a $30 purchase cut down to $15, but apparently it is not the case for others. Whenever my friends see me hand coupons to the cashier, they make a face and say something along the lines of, “It’s not even that expensive. Stop being so cheap.”

Cheap. The dictionary definition of cheap is something that is low in price, but it has become a demeaning label for someone that likes to save money. Since when did saving money become a bad thing? Since when did shopping in the sale section become a bad thing? I’ve seen people pay tens of dollars to buy a shirt from a retail store, but is there anything wrong with using a coupon and getting the exact same shirt for a lower price?

“Cheap” tends to indicate that a person is extremely stingy and reluctant to spend money when actually, being “cheap” means finding ways to get items at a less expensive price than initially marked. Given this definition of being “cheap”, it would be much more accurate to call it “resourceful spending”.

For every cent that we save, it is another cent that we can use for something else. As consumers, we need money to buy the things that we want and as a result, we always need money. If we only had a limited amount of money to spend on all the things that we needed, many of us would be much more careful about what we’re paying for. It is that fact that we have a perception that money is unlimited that causes us to splurge without thinking about what we are actually buying. With the increased use of credit cards and online billing, we are actually seeing the money we are spending and thus prone to spending excessively.

Spending money is something that comes easily to us, but earning money is much harder. For the majority of us students, most, if not all, of the money we spend comes from our parents. We don’t personally have to earn the money that we spend and thus, don’t understand how much work goes into every dollar that we fork over. Once we realize the value behind the number on the bill, maybe saving money will not be such an absurd notion after all.

Graphic by JENNY QIU