For college students, the time after graduation opens up a vast sea of opportunities. It is the ideal time for them to utilize their knowledge and begin working towards goals with their skillset. That is, until they realize the burden of college debt looming over their lives.

College tuition is expensive. The amount of money American college students owe for tuition is increasing at a rate of 4% annually. From 2006 to now, there has been a substantial 72% increase in student debt, and typical student loans can take over ten years to repay. This limits students from living their lives to the fullest potential. The total amount of money owed for student loans in the U.S is approximately $1.77 trillion, and around $28,950 is owed per person. For a student who has just graduated, the significant debt is impossible to pay back in a short amount of time, because there are a smaller amount of job opportunities available to those freshly out of college. It takes time to build experience, which means they will start out with lower-paying jobs which fulfill the debt at a slower rate. A solution offered is to forgive all student debts owed from loans. Although it poses certain disadvantages, the positives outweigh the drawbacks.

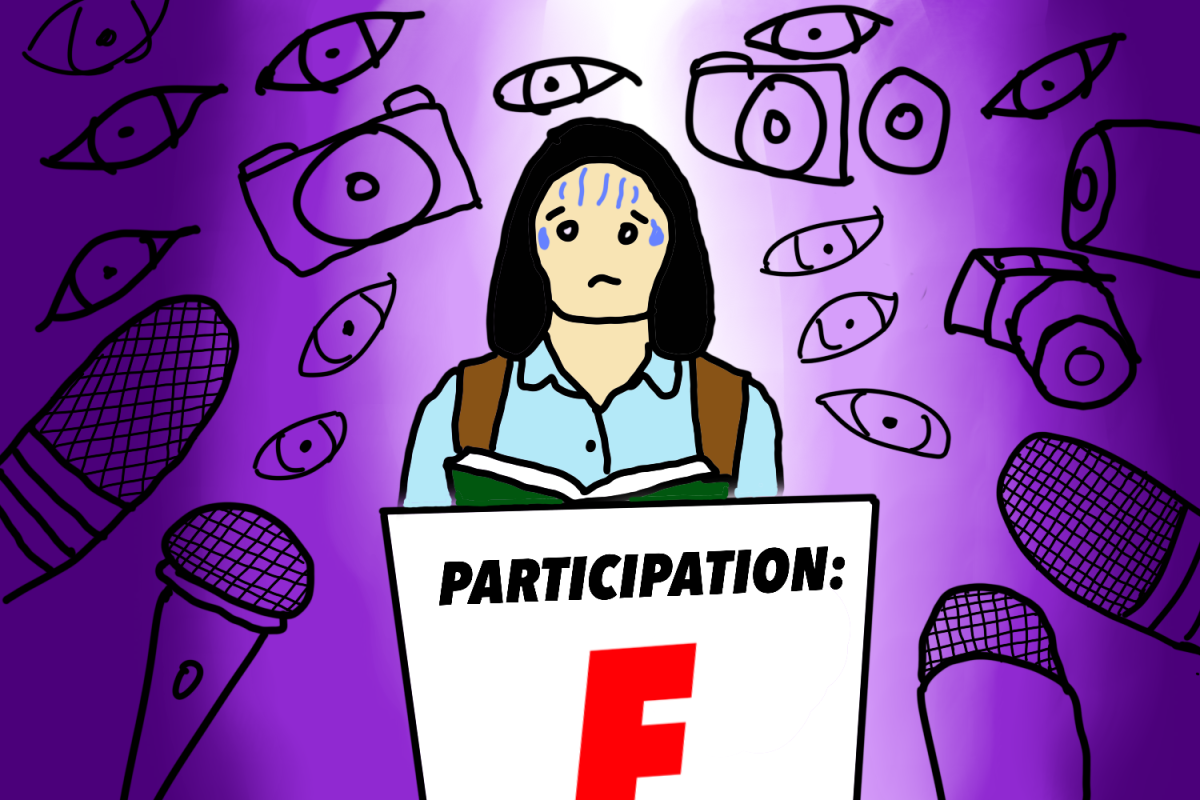

College debt affects almost every single area of a student’s life. Studies show debt delays huge milestones like getting married and having children. In addition, student debt is a huge hindrance and restricts opportunities for graduates, as they spend a lot of their lives scrambling to gather sources of income to return this money instead of pursuing their dreams. For those with tuition debt, an even greater amount gets deducted from their monthly pay, which lowers the quality of their lifestyle. With debt always just one step ahead of them, it becomes nearly impossible for students to buy a home or rent a place in good condition.

Today, credit has high importance, and is needed especially for credit cards and mortgages. College debt hinders credit, for the more a student owes for tuition, the lower their credit scores will be. Due to this, they will be considered more untrustworthy by banks and other financial institutions, preventing them from qualifying for loans, services, and homebuying. Additionally, lower net pay makes it harder for them to save any money. Debt is also harmful for graduates in the long term. Since it becomes difficult for them to save money with their low income, they also can’t save for the times ahead. Retirement funds become outside their scope, as there isn’t any money to spare for future use. Student debt is harming new college graduates in the present and making a mark on their future. To improve their life circumstances, it has to be eradicated.

Is it constitutional for the government to forgive college debts? Initially, the act that denied college debt to be forgiven was the HEROES Act, which states student loans can be released only in drastic issues, such as national emergencies. The recent COVID-19 pandemic can be considered a national emergency, which authorizes the government to forgive college debt under the HEROES Act. An additional example is the The Higher Education Act (HEA), which was passed in 1965. Under Title IV, it allows federal student loans to be released without specific requirements. Title IV also enables grant programs for students and permits financial assistance towards families struggling to repay debt. The HEA has been used in the past to forgive student debt. One example of this is when $42 billion was approved to be forgiven between October 2021 and May 2023. These acts are evidence that there are documents that deem it constitutional for the government to forgive student loans.

Although debt relief will greatly ameliorate the lives of college graduates, there are also problems that need to be considered. Many believe that forgiving student debt is unfair to people who had to work to pay off their loans, and that it isn’t holding debtors accountable for their economic choices. Another point raised is that tuition inflation is a more urgent issue and should be dealt with before forgiving debts. While these points hold truth in terms of morality, forgiving student debts is still the favorable choice for the present. Past students have received financial aid, which proves forgiving student debts now won’t be a first-time action. For instance, the GI Bill of 1944 assisted veteran students in returning their loans. Debt forgiveness does not harm past debt holders, and should not be labeled as unfair. Having current students benefit is much better than having no one benefit at all. As for the second point, tuition inflation should not be considered more urgent than helping graduates with college debt. It is more important to focus on the moral problems graduates have instead of economic incentive. Limits have been set on the future of current graduates, and the step that needs to be taken to change it is forgiving their debts.

Although it is argued that a lack of loan repayment will increase spending and lead to inflation, forgiving college debt will not be heavily harmful towards the economy in the long-run. The main issue brought up with inflation and student debt is that if student debt is not repaid, it will cause excess government spending, and will lower GDP. However, the effect of forgiving college debt on both of these is minimal. If student debt is entirely canceled, the initial decrease in GDP will only be at 0.1%, and the effects will only lessen in the subsequent years. As for the federal deficit, the increase is only 0.4%, which is an unmoving amount.

Furthermore, people who graduate from college are likely to become more stable financially, and generate more income after graduating. Research shows that compared to high school graduates, college graduate men will make an average of $655,000 more in earnings, while college graduate women will make an average of $450,000 more. This will be beneficial to the economy, as these people will now have the ability to make their financial decisions without burden, leading to an increase in homeowners and small-business startups.

So, the effects of debt cancellation on the strength of the economy are not only minimal, they are also only negative in the short-term. Looking ahead, debt cancellation is not detrimental for our economy and will also significantly boost the earnings of an average college graduate in America, meaning it results in greater advantages in the long run.

Taking into consideration all the outcomes of forgiving college debt in the U.S, it is clear that college graduates should be freed of their debts due to the many hardships they face and the burden they have to carry. Loans are getting in the way of their lives and are a barrier in every aspect. College debt needs to be forgiven to allow graduates to lead a successful life and have security in their future.

Photo courtesy of LAURYN CHAO